Physics Wallah vs Byju’s vs Unacademy: Who Wins the Indian Edtech Battle in 2025?

August 23, 2025

Industry: Edtech

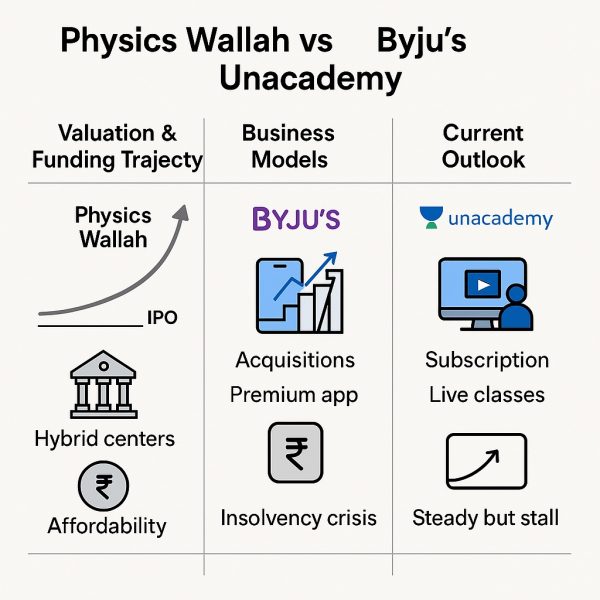

In 2025, Physics Wallah surged with ₹1,940 crore revenue yet net losses surged due to accounting adjustments; Byju’s remains mired in insolvency after dramatic valuation collapse; Unacademy is now “default alive,” cutting cash burn from ₹1,000 crore to ₹200 crore and stabilizing with profitable offline centers.

1. Physics Wallah: Rapid Revenue Growth Amid Losses

- Operational Revenue grew from ₹744 crore in FY23 to ₹1,940 crore in FY24, a 160% jump.

- Net loss widened from ₹84 crore to ₹1,130 crore, largely due to ₹756 crore in non-cash accounting adjustments.

- The company targets over ₹1,050 crore in offline revenue for FY25, expanding from 124 to nearly 200 physical centers across India.

- Backed by a Series B round of $210 million in 2024, Physics Wallah is now valued around $2.8 billion.

Investor Insight: Tremendous growth trajectory with strong Tier-2/3 presence, but rising losses and aggressive scaling raise concerns.

2. Byju’s: From Unicorn to Insolvency Turmoil

- At its peak in 2022, Byju’s was valued at $22 billion, making it one of the world’s most valuable edtech firms.

- By 2025, its valuation effectively dropped to zero amid mounting debt, lawsuits, and insolvency proceedings.

- Byju’s aggressive acquisitions, weak accounting practices, and unsustainable expansion led to a rapid collapse.

Investor Insight: A cautionary tale of how unchecked growth and over-leverage can unravel even the largest edtech.

3. Unacademy: Burn Tamed, Sustainability in Sight

- In FY22-23, Unacademy reported revenue of about ₹1,044 crore with a net loss of ₹1,678 crore.

- The company dramatically reduced its annual cash burn—from nearly ₹1,000 crore in 2021 to below ₹200 crore by 2025.

- Unacademy is now considered “default alive,” with ₹1,200 crore in cash reserves and profitability in offline verticals such as Graphy and PrepLadder.

Investor Insight: A turnaround story that demonstrates financial discipline, diversification, and resilience.

4. EdTech Sector Context & User Dynamics

- The Indian EdTech market is estimated at USD 18–20 billion in 2025 and is projected to reach USD 29 billion by 2030.

- More than 37 million paid learners are expected by 2025, signaling sustained demand for digital and hybrid learning.

- Offline expansion—once viewed as old-fashioned—has now become a strategic pillar for stability.

5. Summary Comparison Table

| Company | FY24 Revenue (₹cr) | Profit/Loss (₹cr) | Highlights |

|---|---|---|---|

| Physics Wallah | ~1,940 | Loss: ~1,130 (includes accounting hit) | Fastest online growth, major offline push |

| Byju’s | — | Insolvency proceedings | From $22B peak to collapse, failed expansion |

| Unacademy | ~1,044 | Loss: ~1,678 | Cash burn cut drastically, offline profits |

6. Strategic Outlook

- Physics Wallah:

Strengths: Explosive growth, vernacular offerings, rapid offline scale.

Risks: Heavy losses, reliance on expansion, accounting adjustments. - Byju’s:

Status: Insolvent, once a $22B giant. Now a lesson in reckless expansion and debt-driven growth. - Unacademy:

Strengths: Leaner operations, profitable offline verticals, healthier reserves.

Outlook: Positioned for sustainable growth with focus on niche products and hybrid models.

7. Value Investing Takeaways (2025)

- Physics Wallah: A high-growth but high-risk play. Strong regional moat but needs profitability discipline.

- Unacademy: A turnaround bet—leaner, cash-efficient, with credible offline strategies.

- Byju’s: Uninvestible in 2025. A reminder that size without sustainability is a ticking time bomb.

8. Conclusion

The battle for India’s EdTech leadership has shifted dramatically by 2025:

- Physics Wallah is the growth engine, combining online scale with an expanding offline network.

- Unacademy is stabilizing, cutting losses, and finding a path to profitability.

- Byju’s stands as a cautionary example of hubris and overreach.

For investors, the sector still offers opportunity—particularly with Physics Wallah’s expansion and Unacademy’s turnaround—but sustainability and financial discipline must now be the filters for value investing in Indian EdTech.