Nykaa vs Purplle: Detailed Comparison of India’s Top Beauty Ecommerce Players

August 23, 2025

Industry: Ecommerce

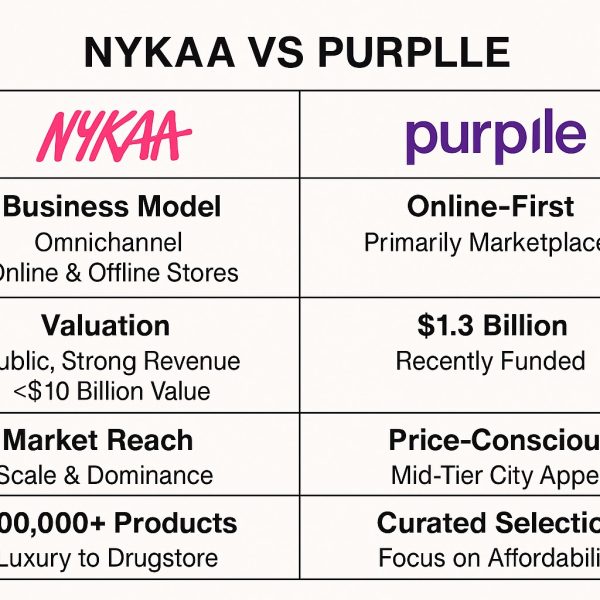

In 2025, Nykaa leads the beauty e-commerce space with over $975 million in annual revenue (~₹8,000 crore) and strong omnichannel presence. Purplle trails with ₹680 crore in revenue (FY24) but has halved losses. Nykaa remains premium while Purplle dominates value-conscious segments.

1. Introduction: Beauty’s Digital Revolution

India’s beauty and personal care sector has undergone a remarkable transformation in the last decade. With the rise of digital marketplaces, consumers no longer rely solely on brick-and-mortar stores to discover products. Instead, online-first platforms like Nykaa and Purplle have disrupted traditional retail by curating assortments, offering affordable deals, and providing personalized shopping experiences.

The Indian beauty and personal care market is estimated at over USD 20 billion in 2025 and expected to cross USD 30 billion by 2027. Online penetration is still less than 15%, leaving significant headroom for growth. Consumer demand is split: premiumization driven by aspirational Gen Z and millennials in metros, and affordability-driven demand in Tier-2/3 towns. Nykaa and Purplle embody these two distinct philosophies.

2. Company Overviews

Nykaa

A pioneer in India’s beauty e-commerce, Nykaa operates across beauty, wellness, and fashion with a strong omnichannel presence—over 100 physical stores and extensive online offerings. FY24 annual revenue was approximately $975 million (~₹8,000 crore). Its premium brand positioning, fashion vertical expansion, and professional services arm (Nykaa PRO) reinforce its market leadership.

Purplle

Founded in 2012, Purplle positioned itself as a budget-friendly alternative to Nykaa. It emphasizes affordability through a wide private-label portfolio, aggressive promotions, and AI-powered personalization. In FY24, the company generated ₹680 crore in revenue, representing a 43% year-on-year increase, while narrowing its net loss from ₹230 crore to ₹124 crore. With unicorn status (valued over $1.2 billion), Purplle is now one of India’s fastest-growing beauty retailers.

3. Financial Snapshot & Profitability

- Nykaa:

- FY24 revenue approx. ₹8,000 crore.

- Positive EBITDA and consistent quarterly profits despite rising competition.

- Diversified revenue streams: beauty contributes ~70%, fashion ~25%, and “other services” ~5%.

- Purplle:

- FY24 revenue: ₹680 crore (up from ₹475 crore in FY23).

- Net loss narrowed sharply, halving from ₹230 crore to ₹124 crore.

- Gross margins boosted by private-label brands like Good Vibes and Purplle Essentials.

4. Strategic Positioning & Market Focus

- Nykaa: Premium-first, curates international brands, indie labels, and exclusive partnerships. Its omnichannel presence allows consumers to test and buy seamlessly across online and offline touchpoints.

- Purplle: Value-first, targeting Tier-2 and Tier-3 consumers with affordable SKUs. Its growth engine lies in private labels and AI-based personalization for budget-conscious users.

5. User Experience Comparison

- Nykaa: A polished, aspirational interface with curated collections, beauty tutorials, and influencer-driven discovery. Its offline stores build trust and amplify brand discovery.

- Purplle: Mobile-first, optimized for discounts, personalized recommendations, and combo deals. It appeals to digital natives in smaller cities who want value without compromising on choice.

6. Industry Context & Competitive Pressures

The battle is not just Nykaa vs Purplle—new entrants are intensifying the fight:

- Reliance’s Tira: Backed by Reliance Retail, Tira is scaling both online and offline, posing a formidable challenge with deep pockets and strong retail networks.

- Tata CLiQ Palette: Positioned as Tata’s premium beauty marketplace, competing head-to-head with Nykaa in metros.

- Quick-commerce players: Blinkit and Zepto have entered beauty, offering instant delivery for everyday beauty items, reshaping convenience expectations.

This competitive intensity means both Nykaa and Purplle must balance growth with profitability.

7. Detailed Company Strategies

Nykaa

- Expanding its fashion vertical (Nykaa Fashion), now contributing ~25% of revenue.

- Investing in tech-driven personalization—virtual try-ons, AI beauty assistants.

- Scaling offline presence to over 150 stores by 2026 to deepen trust and accessibility.

- IPO journey: listed in 2021 at a valuation of ~$14 billion; currently trades around ~$7 billion market cap.

Purplle

- Raising capital to expand private-label brands and logistics.

- Strong focus on affordability—90% of SKUs priced below ₹500.

- Penetration in Tier-2/3 cities, where Nykaa’s premium positioning struggles.

- Digital-first campaigns and influencer-led marketing on Instagram, Moj, and ShareChat.

8. Comparative Overview Table

| Category | Nykaa | Purplle |

|---|---|---|

| FY24 Revenue | ~₹8,000 crore | ₹680 crore (43% growth) |

| Profitability | EBITDA positive, modest net profits | Net loss ₹124 crore, but narrowing fast |

| Positioning | Premium, curated, omnichannel | Budget-friendly, deals-driven, mobile-first |

| Strengths | Brand equity, wide range, store presence | Private labels, affordability, agile marketing |

| Risks & Challenges | Margin pressure, Reliance/Tata competition | Thin margins, dependency on promotions |

9. Future Outlook (2025–2030)

- Nykaa: Likely to consolidate leadership in premium beauty, expand fashion, and deepen offline networks. Focus on profitability and maintaining investor trust post-IPO will be crucial.

- Purplle: Positioned to scale aggressively in Tier-2/3 towns. If it can sustain growth while improving unit economics, Purplle may emerge as India’s leading value beauty retailer.

- Industry Trends: Expect greater use of AR/AI for virtual try-ons, increased D2C brand tie-ups, sustainability-driven products, and possible consolidation among players.

10. Value Investing Takeaways

- Nykaa: A relatively stable investment, blending growth with profitability and brand trust. Suited for investors seeking long-term resilience.

- Purplle: A higher-risk, higher-reward bet. Strong revenue growth, narrowing losses, and untapped Tier-2/3 potential make it attractive—but operational efficiency remains the key watchpoint.

Conclusion

India’s beauty e-commerce is a tale of two philosophies:

- Nykaa represents aspiration, premium experiences, and trusted omnichannel presence.

- Purplle embodies affordability, accessibility, and digital-first growth in emerging markets.

Both are strong in their lanes. For investors, Nykaa offers stability with profitability, while Purplle offers aggressive growth potential if costs are managed well.